Committed to Sustainable Cities and Human Settlements for All

In Special Consultative Status with ECOSOC

Keywords: green building, green finance, carbon emission reduction

1. The potential of green finance supporting green buildings has not been fully realized

In June 2018, the Opinions of CPC Central Committee and the State Council on Comprehensively Strengthening eco-environmental Protection and Resolutely Winning the Battle of Pollution Prevention and Control pointed out: ‘build a beautiful China, encourage the use of green building materials in new buildings, vigorously develop prefabricated buildings and increase the proportion of new green buildings’. Vigorously developing green buildings and reducing energy consumption, water consumption, air pollution and carbon dioxide emissions through green buildings are not only the inevitable requirements of China’s construction of ecological civilization, but also China’s responsibility as a big country in dealing with climate change.

In 2013, the State Council forwarded the Green Building Action Plan, pointing out that price, finance, taxation, fiscal policy and other economic measures should be comprehensively used to give full play to market’s basic role in allocating resources, creating a market environment conducive to green building development, and stimulating the endogenous driving force of market players in the design, construction and use of green buildings. However, the development of green buildings in China has been mainly depending on administrative strength and fiscal funds for a long time, while market-oriented mechanism has not yet been formed. Since the Thirteenth Five-year Plan period, fiscal funds have been gradually unable to meet the needs of green development in the building industry, and the traditional promotion work needs to be combined with green finance to form a comprehensive supporting system of land, price, fiscal policy, taxation and finance.

Green development of building industry includes energy-saving renovation of existing buildings and new green buildings, which are quite different in project process, stakeholders, financing process and characteristics. This paper only analyzes the new green buildings, and the "green buildings" in this paper specifically refers to the new buildings that meet the national green building standards.

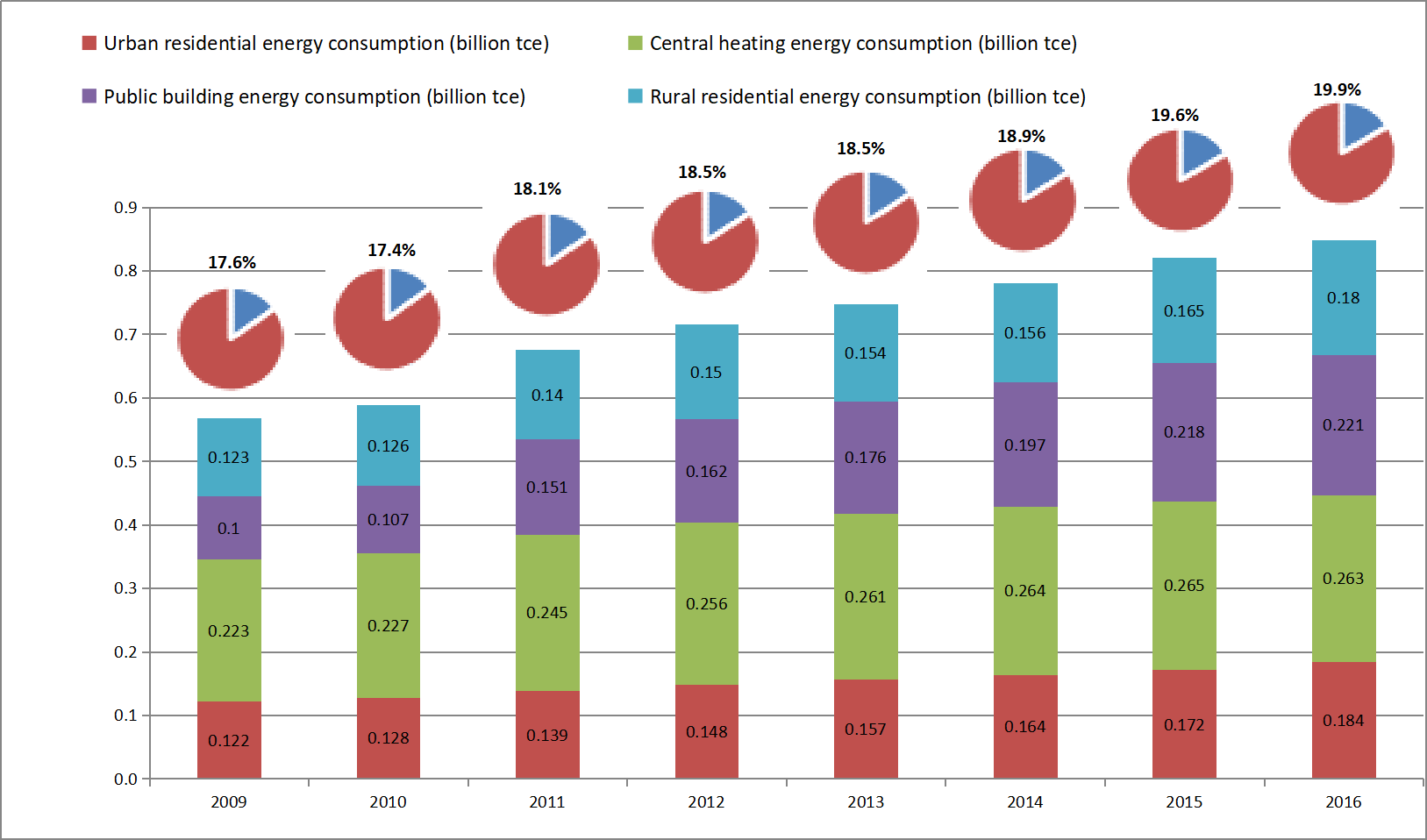

The energy consumption of civil

buildings accounts for a large proportion of energy consumption in China. According

to a study by the Center of Science and Technology and Industrialization

Development, MOHURD, from 2009 to 2016, the total energy consumption of civil

buildings in China increased from 568 million tons of standard coal to 848

million tons of standard coal, with an average annual growth rate of 5.9%. In

2016, the energy consumption of civil buildings accounted for 19.9% of the

total terminal energy consumption of the whole society. And from the experiences

of developed countries, with the progress of urbanization and the improvement

of people's living standards in China, building energy consumption is likely to

continue to grow, accounting for 40% of the terminal energy consumption of the

whole society at its peak. In addition, from the perspective of carbon

reduction, Reshaping Energy: China (2016)1 points out that

the building sector will contribute about 50% of energy savings to earlier peak

time of carbon emissions.

Figure 1-1: Energy consumption of all kinds

of civil buildings in China and the proportion of

energy consumption of civil

buildings to the terminal energy consumption of the whole society2

The development of green

buildings in China has entered the fast lane. During the Thirteenth Five-year Plan period, the

government has begun to promote green building development in an all-round way.

The goals set out in the Outline of the Thirteenth Five-year Plan for

Housing and Urban and Rural Construction include: by 2020, the energy

efficiency level of new urban buildings will be 20% higher than that of 2015;

the proportion of green buildings in all new buildings will be increased from

20% to 50%; the proportion of green buildings with green building sign that

obtains the two-star under national green building standards will be increased

from 59% to 80%; the proportion of buildings with green operation label will be

increased from 6% to 30%; the proportion of green building materials use will

exceed 40%; the proportion of energy-efficient buildings in existing urban

residential buildings nationwide will be more than 60%, and the area of new

green buildings nationwide will reach more than 2 billion square meters.

The green building standards in China are gradually being improved. In 2006, the Ministry of Housing and Urban-Rural Development (MOHURD) issued China's first green building evaluation standard Green Building Evaluation Standard (GB/T50378-2006). In 2019, MOHURD issued the latest Green Building Evaluation Standard (GB/T50378-2019) which has come into force since August 1, 2019. The newly revised Green Building Evaluation Standard links green financial services with green buildings for the first time, making it clear that building projects applying for green financial services should provide a special report that includes calculation and explanation about energy-saving measures, water-conservation measures, energy consumption, carbon emissions, and others.

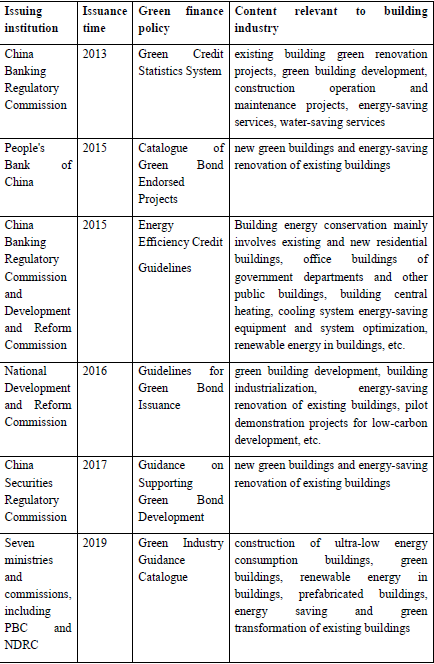

Green finance has included green building into its supporting areas. The Green Credit Statistics System promulgated by the CBRC in 2013 incorporated "building energy efficiency and green buildings" into the green credit statistics. The Catalogue of Green Bond Endorsed Projects issued by People’s Bank of China (PBC) in 2015 classified "new green buildings" and "energy-saving renovation of existing buildings" as "sustainable buildings". In 2019, the National Development and Reform Commission and other six ministries jointly issued the Green Industry Guidance Catalogue (2019 Edition) which classified "building energy efficiency and green building" as "infrastructure green upgrade", including sub-categories of "ultra-low energy consumption building construction", "green building", "building renewable energy application" and "prefabricated building".

Table 1-1 Summary of green finance policies supporting green development of building industry3

Green finance has already started supporting green

building. Financial

institutions has begun to explore related financial products and tools,

including green credit, green bonds, green

CMBS4, REITs-like securitization products, green building insurance

products5, green-building-themed funds and so on. From the

perspective of market size, the main products supporting green buildings are

green credit and green bonds.

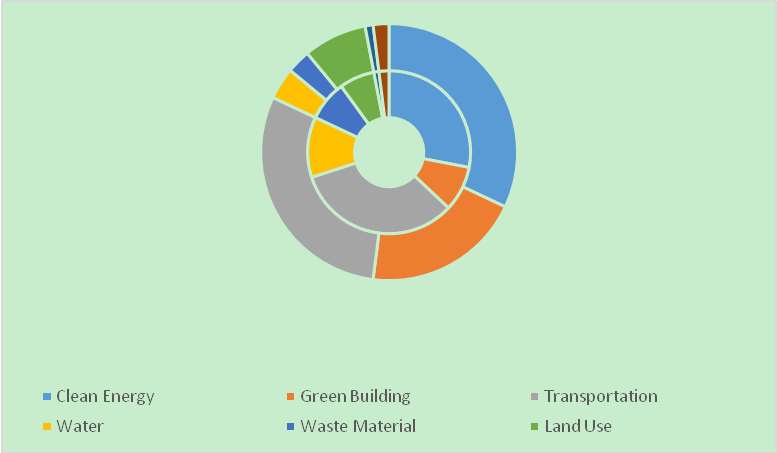

In

terms of green credit, according to the statistics of PBC, by the end of

the second quarter of 2019, the balance of domestic and foreign currency green

loans was 9.47 trillion yuan,

accounting for 9.9% of the loans of enterprises and other entities in the same

period6. In terms

of fund using, green transportation projects and renewable/clean energy

projects took up the highest proportion of green loans, accounting for 45% and

24%, respectively. In the same period, the balance of real estate development

loans is 11.04 trillion. Based on the proportion goal of green buildings in the

Thirteenth Five-year Plan, nearly half of the development loans should be green

credit, while according to a number of banks, the actual situation is that

green construction credit is far from reaching this ratio (the balance of green

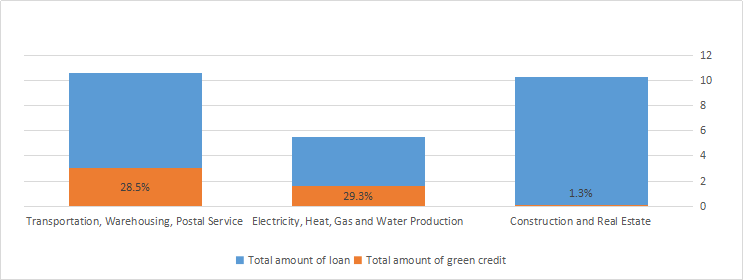

credit in the building industry is yet to be disclosed). According to the

statistics of CBIRC, as of June 2017, the green credit balance of 21 major

banks totaled 8.3 trillion, while the balance of energy-efficient and green

building projects was 134.8 billion yuan,

accounting for only 1.6 percent7. According to the credit data of

the same period8,the loan balance of transportation,

warehousing and postal services was 10.6 trillion, with green loans accounting

for 28.5%; the loan balance of electricity, heat, gas and water production and

supply industries was 5.5 trillion, with green loans accounting for 29.3%; and

the loan balance of construction and real estate industry was 10.3 trillion,

with green loans accounting for only 1.3%. From the above figures, it can be

seen that compared with energy and other sectors, the green degree of loans in

building and real estate industry is still very low.

Figure1-2:China's credit balance statistics by sector (trillion) and the proportion of green credit in June 2017

Data source: The research

group calculated the balance of local and foreign currency loans according to

Wind sector statistics.

(the inner circle indicates China)

Data sources: Climate Bond Initiative (CBI) 's China Green Bond Market Report 2018

and European Green Bond Market Report 2018.

Thus, according to the current market situation, although there already exists some financial instruments supporting green building development, the support of green finance is still insufficient. The function of green finance promoting green building development (for example, after issuing green bonds, due to disclosure and other requirements, developers are faced with pressure to ensure the whole-process greenness) has not been effectively brought into play.

2. Obstacles in green finance supporting green building

Currently, there exists various obstacles in green finance supporting green building. According to our field researches in Beijing, Huzhou and Qingdao, major obstacles include: 1) real estate regulation policies do not have differentiated implementation when it comes to green buildings; 2) the industry supervision policies and supporting measures of green buildings are insufficient; 3) the time mismatch of incremental costs and incremental benefits; 4) SMEs in the green building supply chain face financing difficulties; 5) insufficient activation of consumer end; 6) lack of related green finance supporting policies and product system.

2.1 Real estate regulation policies do not have differentiated implementation when it comes to green building

Green building is a kind of real estate product encouraged by China. However, when the central government exercises macro-control over real estate industry, there is no differentiated implementation between “green” and “non-green” buildings. Since 2019, the central government has clearly proposed “not to use real estate as a short-term means to stimulate economy”, which shows its firm attitude towards real estate regulation and control. Relevant central departments also think that real estate industry occupies relatively excess financial resources, and made clear specific requirements for controlling real estate credit and non-bank financing, without differentiating green building development from common real estate development. In this context, the support of financial institutions for green buildings is easy to been seen as supporting real estate which is contrary to regulatory policies. Therefore, many commercial banks and non-bank financial institutions are unwilling or unable to support green building development.

2.2 The management and evaluation mechanism of green building certificates is still absent

How to ensure green buildings are “green” during their full life cycle is a major obstacle for building regulatory authorities. According to the new green building national standard (2019), the original “design evaluation certificate” has been canceled and replaced by “pre-evaluation after completion of construction design” which will not provide certificate but another form of credential. Theoretically, green building development enterprises could use this “pre-evaluation” credential to apply for green capital. However, in practice, without clear and specific management policies of this credential and its linkage to green finance policies, financial institutions find it difficult to use this credential to provide green financial services. On the other hand, after completion and acceptance of green building projects, the management and evaluation mechanism regarding green building certificates during its operational phase is still absent. Also, information disclosure mechanism of green buildings is yet to be established, so that industry regulators, financial institutions and consumers can not timely learn and monitor whether the actual operation of those buildings meet the green standards. This obstacle makes it difficult to ensure green benefits of green buildings during their operation phase and has dwindled the motivation of financial institutions to support green buildings as well as the interest of consumers to purchase or rent green buildings.

2.3 Time mismatch of incremental costs and incremental benefits

The development of green building projects needs more input in the early stage compared with traditional construction projects, such as incremental costs of using green technologies, equipment and materials, costs of green building design, simulation and application, and additional cost for certification. Since green buildings can reduce operating costs including electricity and water fees, and the living environment is better than ordinary buildings, theoretically, for developers and investors, their incremental costs should be made up by increasing selling or rental price to solve the time mismatch between short-term incremental costs and long-term incremental benefits.

However, in practice, due to the following reasons, such mismatch may not be solved properly. First, many home buyers and tenants in China currently have little knowledge of green buildings and limited understanding of its benefits such as water and electricity saving, environmental protection and improved health. What’s more, they generally do not know how to translate the water and electricity saved in the future into present value so that they are not willing to pay for the incremental costs (high price). Second, under the no-difference real estate financial regulation and control policies, most financial institutions do not fully consider the long-term benefits of green buildings when providing development loans and mortgage loans so that they do not offer preferential loan interest rate or higher line of credit for green building projects. Third, in terms of industry policies, government has not provided preferential incentives for green buildings such as price limit relaxation or floor area relaxation, making it difficult for developers and investor to hedge to time mismatch problem.

2.4 Small and medium-sized enterprises in the green building industrial chain face financing difficulties

Green building industrial chain involves many entities. Apart from large real estate developers, there are many small and median-sized private enterprises including those on green building materials and energy-saving service. These enterprises have certain level of green technology innovation capability, but most of them are light capital and high credit risk enterprises and have difficulties in providing qualified collateral to financial institutions.

On one hand, due to the lack of green benefits evaluation and information disclosure mechanism, it is difficult for financial institutions, including guarantee companies, to directly measure the value of green technologies of these SMEs. One the other hand, the lack of evaluation system of “green credit” of these enterprises makes it difficult for financial institutions to accurately evaluate their “green credit” and overall credit risk, so that financial institutions are unwilling to provide financing or guarantee for them. Such financing difficulty of these SMEs is not conducive to the long-term development of the green building industry.

2.5 The demand side of green building has not been activated

First, consumers have insufficient awareness of green buildings. The development of green buildings started late in China, which led to the public’s poor awareness of green buildings and their benefits. Besides, in the context of China’s basic condition, most consumers are very sensitive to the housing prices and unwilling to bear the relatively high price of green buildings. Therefore, at present China’s consumers’ spontaneous demand for green buildings is apparently inadequate, which brings uncertainty for real estate developers to invest in green building projects.

Secondly, consumers do not believe in the financial benefits of possible energy and water conservation. Even if the developer promotes the benefits of green buildings, consumers cannot intuitively understand the energy-saving benefits of green buildings, due to the lack of corresponding monitoring and information disclosure mechanisms for the operation and maintenance stage of green buildings.

For these reasons, the consumer market of green buildings in China has not been effectively activated and the price advantage is not evident, hindering developers to invest in green building market.

2.6 Financial products need to be improved and innovated

In addition to the policy-level issues, due to the low innovation capability of financial institutions, the green financial products are unable to well match the development of China’s green building market. There are a few examples as follows.

1) Except for a couple of financial institutions, the vast majority of banks in China lack research on the default rate of green development loans and green mortgage loans. Considering the relatively low credit risk of the green loans, they should be able to provide lower the interest rate (the credit risk premium part of interest rate)11. Since there is no preferential interest rate, it is difficult to incentivize more green building financing from the demand side.

2) Few financial institutions in China have attempted to securitize green development loans, green mortgage loans, and other green assets related to construction (such as photovoltaic assets on the roof), so institutional investors (such as insurance companies, fund companies, etc.) basically have no channel to invest in green building related assets.

3) With the exception of PICC, most insurance companies in China have not yet set foot in green building insurance. In fact, green building insurance (guaranteed buildings meet the environmental benefits such as energy and water conservation claimed by developers) can largely alleviate the problem of insufficient demand caused by investors’ and consumers’ constraints in estimating the benefits of green buildings.

4) The carbon emission reduction of green buildings should be included in the carbon market as China Certified Emission Reductions (CCER). However, China’s exsiting carbon trading market is unable to accommodate such products due to immature mechanism design.

3. Conclusion and policy suggestions

Green building has huge potential of carbon emission reduction and market development, and should be one of the key industries of green development in China. But for a long time, the green development of building industry is mainly supported by administrative measures and fiscal funds, without market-oriented incentive and development mechanism. In order to make better use of the limited financial funds and mobilize social capital to invest in the field of green buildings, it is essential to make full use of the green financial policies and instruments in China to promote sustainable development of green building industry.

Some attempts have been made to support green buildings through green financing, but there is a long way to go. In this regard, there are various obstacles at the macro, industry, and micro levels. In response to these challenges, we propose the following recommendations.

First, in the process of regulating real estate industry, green building projects should be treated differently from traditional real estate development projects. Currently, the main purpose of the macro control over real estate industry is to prevent financial risks brought by high-leverage financing of real estate enterprises and to curb its extensive growth. We recommend that, on the premise of ensuring the objective of quantitative control (such as controlling the loan growth rate and overall leverage level of the real estate industry), the government should focus on restricting “non-green” real estate enterprises and projects, and give relatively loose financing conditions to eligible developers and projects, that is, “restructuring” under “quantitative control”.

Second, improve the operational certification system of green building industry. (1) Establish sound management system of green building certificates, including evaluation, supervision and corresponding punishment mechanism in buildings’ operational phase, ensuring green buildings are always “green” during their full life cycle. (2) Improve the information disclosure mechanism so that stakeholders including regulators, consumers, financial institutions and property companies can conveniently and timely understand the “green information” of buildings during their full life cycle, bridging the information gap. (3) Establish an information database and credit evaluation system for green building enterprises and projects, which can not only reduce the cost of financial institutions in seeking green building investment targets and their investment risks, but also lower financing cost for related enterprises.

Third, solve the financing problem of SMEs in the green building industry by means of supply chain finance. With sound green credit system and information disclosure mechanism in place, supply chain finance could provide customized financial services for SMEs in the green building industry through risk control over large real estate enterprises and related product design. On the one hand, it can alleviate the financing difficulties of small and medium-sized enterprises in the industrial chain, on the other hand, it can improve the efficiency of the use of institutional funds, and transform the uncontrollable risks of individual enterprises into controllable risks of the entire supply chain.

Fourth, improve consumers’ perception of green building and activate the consumption market. On one hand, the industry regulatory authorities should promote green buildings to enable consumers to better understand the benefits. On the other hand, they should ensure that consumers enjoy the “green benefits” they deserve through green building information disclosure and complementary measures ".

Fifth, financial institutions should develop

innovative financial products according to the characteristics of green

building industry. Financial institutions need to foster innovation to

develop a batch of financial products that take into account the features of

the green building industry. Banks should invest in analyzing the difference

between the default rate of green development/mortgage loans and

"non-green" loans,, and implement differential pricing on this basis.

It is necessary to research and develop securitization products based on green

development/mortgage loans and building photovoltaic assets, and green building

related insurance plans, and carbon trading mechanisms.

Endnotes

1. Joint release by the Energy Research Institute of the National Development and Reform Commission, Lawrence Berkeley National Laboratory, the Rocky Mountain Institute and the Energy Foundation (China)

2. Data source: "investigation and Research report on the current situation of Energy consumption of Civil buildings in China" by the Center of Science and Technology and Industrialization Development, MOHURD

3. The table is compiledby the research group, according to the relevant policy documents of various ministries and commissions.

4. The first green building 820 million CMBS was successfully issued: https://www.sohu.com/a/204982075_803365

5. PICC Property Insurance Beijing Branch issued the first green building performance liability insurance in China:http://www.epicc.com.cn/renbao/zixunzhongxin/xinwen/201904/t20190408_14008.html

6. People's Bank of China, Statistical Report on Loan Investment of Financial Institutions in the Second Quarter of 2019:http://www.pbc.gov.cn/goutongjiaoliu/113456/113469/3865563/index.html

7. China Banking and Insurance Commission, Statistical Table of Green Credit of 21 Major Banks:http://www.cbrc.gov.cn/chinese/home/docView/96389F3E18E949D3A5B034A3F665F34E.html

8. The research group calculated the balance of local and foreign currency loans according to Wind sector statistics.

9. Climate Bond Initiative, Central National Debt Registration and Clearing Co., Ltd., China Green Bond Market report 2018:https://www.chinabond.com.cn/cb/cn/yjfx/zzfx/nb/20190227/150962459.shtml

10. CBI, The Green Bond Market in Europe 2018: https://www.climatebonds.net/resources/reports/green-bond-market-europe

11. On the contrary, many financial institutions in Europe have realized this fact through researches:

“Home Energy Efficiency and Mortgage Risks” (2013), by the Institute for Market Transformation (IMT); “Impact of energy use and price variations on default risk in commercial mortgages: Case studies” (2017) by Mathew et al.;

“Insulated from risk? The relationship between energy efficiency of properties and mortgage defaults” (2018), by Guin and Korhonen;

“Transition

in Thinking: The impact of climate change on the UK banking sector, case study

1: “Tightening energy efficiency standards and the UK buy-to-let market” (2018),

by the Bank of England.

12. Members of the research group include Liu Jialong, Shao Danqing, Xu Jiaxuan, Jiang Nan and Yang Yifan from the Research Center of Green Finance Development of Tsinghua University, Liang Junqiang, Yin Shuai, Wu Peng and Duan Tianyifrom the Center of Science and Technology and Industrialization Development of the Ministry of Housing and Urban-Rural Development. The research group thanks Dr. Ma Jun, director of the Research Center of Green Finance Development and director of the Green Finance Committee, China Society for Finance and Banking, for his guidance, and the valuable opinions and suggestions from Yang Ping (Research Bureau of the People's Bank of China) and Li Xiaowen (Policy Research Bureau of the CBIRC) at seminars.

戴德梁行. 绿色金融:将绿色投资引入绿色地产[R]. 2018.

https://www.cushmanwakefield.com.cn/images/upload/2/F206F82739ED49A68E11728C705F54EC.pdf

搜狐网. 首单绿色建筑8.2亿CMBS成功发行[N].

2017.

https://www.sohu.com/a/204982075_803365

中国人民财产保险股份有限公司. 人保财险北京分公司签发全国首单绿色建筑性能责任保险[N]. 2019.

http://www.epicc.com.cn/renbao/zixunzhongxin/xinwen/201904/t20190408_14008.html

中国人民银行. 2019年二季度金融机构贷款投向统计报告[R]. 2019.

http://www.pbc.gov.cn/goutongjiaoliu/113456/113469/3865563/index.html

中国银行业监督管理委员会. 21家主要银行绿色信贷情况统计表[R]. 2018.

http://www.cbrc.gov.cn/chinese/home/docView/96389F3E18E949D3A5B034A3F665F34E.html

气候债券倡议组织,中央国债登记结算有限责任公司. 中国绿色债券市场报告2018[R]. 2019.

https://www.chinabond.com.cn/cb/cn/yjfx/zzfx/nb/20190227/150962459.shtml

Climate Bond Initiative, The

Green Bond Market in Europe [R].2018.

https://www.climatebonds.net/resources/reports/green-bond-market-europe

仲联量行. 绿色金融与地产白皮书[R]. 2019.

https://www.joneslanglasalle.com.cn/zh/trends-and-insights/research/green-finance

世邦魏理仕研究部. 2017中国绿色建筑报告[R]. 2017.

https://www.cbre.com.cn/zh-cn/research-reports/2017中国绿色建筑报告

孙大明,邵文晞. 当前中国绿色建筑增量成本统计研究[J]. 动感(生态城市与绿色建筑), 2010(04):43-49.

Institute for Market Transformation (IMT). Home Energy Efficiency and Mortgage Risks [R]. 2013.

https://www.imt.org/wp-content/uploads/2018/02/IMT_UNC_HomeEEMortgageRisksfinal.pdf

Mathew Paul, et al. Impact of energy use and price variations on default risk in commercial mortgages: Case studies [R]. 2017.

https://buildings.lbl.gov/sites/default/files/mortgage-case-studies-9-26-17.pdf

Guin B., Korhonen P.

Insulated from risk? The relationship between energy efficiency of properties

and mortgage defaults [R]. 2018.

https://bankunderground.co.uk/2018/10/16/insulated-from-risk-the-relationship-between-the-energy-efficiency-of-properties-and-mortgage-defaults/

Bank of England. Transition in Thinking: The impact of climate change on the UK banking sector [R]. 2018.

赵建勋,操群. 绿色金融促进绿色建筑持续健康发展的思考[J]. 中国银行业, 2019(02):78-81.

Green Finance: Introducing green

investment into green real estate, Cushman & Wakefield, 2018.

https://www.cushmanwakefield.com.cn/images/upload/2/F206F82739ED49A68E11728C705F54EC.pdf

820 million first green building CMBS

issued successfully, Sohu, 2017.

https://www.sohu.com/a/204982075_803365

PICC Beijing Branch issued China’s first

green building performance liability insurance, PICC, 2019.

http://www.epicc.com.cn/renbao/zixunzhongxin/xinwen/201904/t20190408_14008.html

Statistical report of loan investment by

financial institutions in the second quarter of 2019, People’s Bank of China,

2019.

http://www.pbc.gov.cn/goutongjiaoliu/113456/113469/3865563/index.html

Statistics

of green credit of 21 major banks, China Banking Regulatory Commission, 2018.

http://www.cbrc.gov.cn/chinese/home/docView/96389F3E18E949D3A5B034A3F665F34E.html

Report

on China’s green bond market 2018, Climate Bonds Initiative, China Central

Depository & Clearing Co., 2019.

https://www.chinabond.com.cn/cb/cn/yjfx/zzfx/nb/20190227/150962459.shtml

The

Green Bond Market in Europe, Climate Bonds Initiative,2018.

https://www.climatebonds.net/resources/reports/green-bond-market-europe

White

paper of green finance and real estate, Jones Lang LaSalle, 2019.

https://www.joneslanglasalle.com.cn/zh/trends-and-insights/research/green-finance

Report

on green building in China 2017, Research department of CBRE Group, 2017.

https://www.cbre.com.cn/zh-cn/research-reports/2017中国绿色建筑报告

Daming

Sun, Wenxi Shao, A statistical study on the incremental cost of green building

in China, Dynamics (ecological city and green building), 2010(04):43-49.

Home Energy Efficiency and Mortgage Risks, Institute for Market Transformation (IMT), 2013.

https://www.imt.org/wp-content/uploads/2018/02/IMT_UNC_HomeEEMortgageRisksfinal.pdf

Mathew

Paul, et al. Impact of energy use and price variations on default risk in

commercial mortgages: Case studies. 2017.

https://buildings.lbl.gov/sites/default/files/mortgage-case-studies-9-26-17.pdf

Guin

B., Korhonen P. Insulated from risk? The relationship between energy efficiency

of properties and mortgage defaults. 2018.

https://bankunderground.co.uk/2018/10/16/insulated-from-risk-the-relationship-between-the-energy-efficiency-of-properties-and-mortgage-defaults/

Transition in Thinking: The impact of climate change on the UK banking sector, Bank of England, 2018.

Jianxun Zhao, Qun Cao,Reflection on green finance promoting sustainable development of green buildings,China Banking, 2019(02):78-81.

Copyright © Global Forum on Human Settlements (GFHS)